are donations to politicians tax deductible

The simple answer to whether or not political donations are tax deductible is no. Political Contributions Are Tax Deductible Like Charitable Donations Right.

Charity Navigator Top 5 Things To Remember When Making Political Donations

Taxpayers cannot deduct contributions made to a political candidate a campaign committee or a newsletter fund.

. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized as tax-deductible as per IRS rules and regulations. 1500 for contributions and gifts to political parties. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign.

Most of the time donors have big money and they qualify to be in a millionaire group at least. When it comes time to file taxes though many people may not fully understand what qualifies as a tax deduction. You are not allowed to deduct political contributions from your taxes according to the IRS.

Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees. So its important you dont try to deduct any political contribution on your income tax return. Businesses likewise cannot claim a deduction for political contributions whether theyre pass-through entities or file a corporate return.

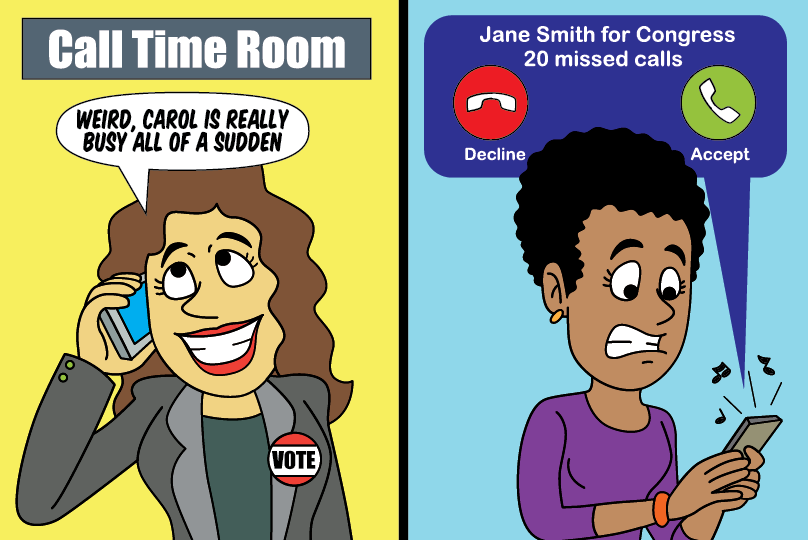

However there are still ways to donate and plenty of people have been taking advantage of them over the past several years. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes.

Its not uncommon to mistake the tax deductibility of political contributions. A tax deduction allows a person to reduce their income as a result of certain expenses. Even so they are not exempted from taxes on political donations as per the US federal law.

Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS. View solution in original post. In any case you have to pay taxes on your political donations.

Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether they itemize or claim the standard deduction. You need to claim your tax deduction for a political contribution or gift in the income year you made the contribution or gift. No donations to political parties are not tax deductible.

Simply put political contributions are not tax-deductible. This may comprise of literacy scientific religious child care and also amateur. So if you support your favorite candidate you.

You cant deduct contributions of any kind cash donated merchandise or expenses related to volunteer hours for example to a political organization or candidate. Political contributions deductible status is a myth. And businesses are limited to deducting only a portion.

As more and more people have become politically involved in recent elections especially at the national level the amount of. The confusion usually arises over the difference between political contributions and charitable contributions. The simple answer to whether or not political donations are tax deductible is no.

Political contributions arent tax deductible. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. In 2022 an individual may donate up to 2900 to a candidate committee in any one federal election up to 5000 to a PAC annually up to 10000 to a local or district party committee annually and up to 35000 to a national party.

1500 for contributions and gifts to independent candidates and members. While you cant write off campaign contributions you can set aside 3 of your taxes to go to the Presidential Election Campaign Fund on your 1040 federal income tax return. In a nutshell the quick answer to the question Are political contributions deductible is no.

This includes Political Action Committees PACs as well. Yes there are various charity programs that provide tax deductions but it is vital for you to know the restrictions of your contributions. According to IRS standards companies that work under 501 c 30 are liable for tax deduction for charitable acts.

We hear this question from time to time. However the truth is that political donations are not tax-deductible. Generally individuals cant deduct business entertainment expenses until the 2026 tax year thanks to tax reform.

Montana offers a tax deduction. There are five types of deductions for individuals work. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

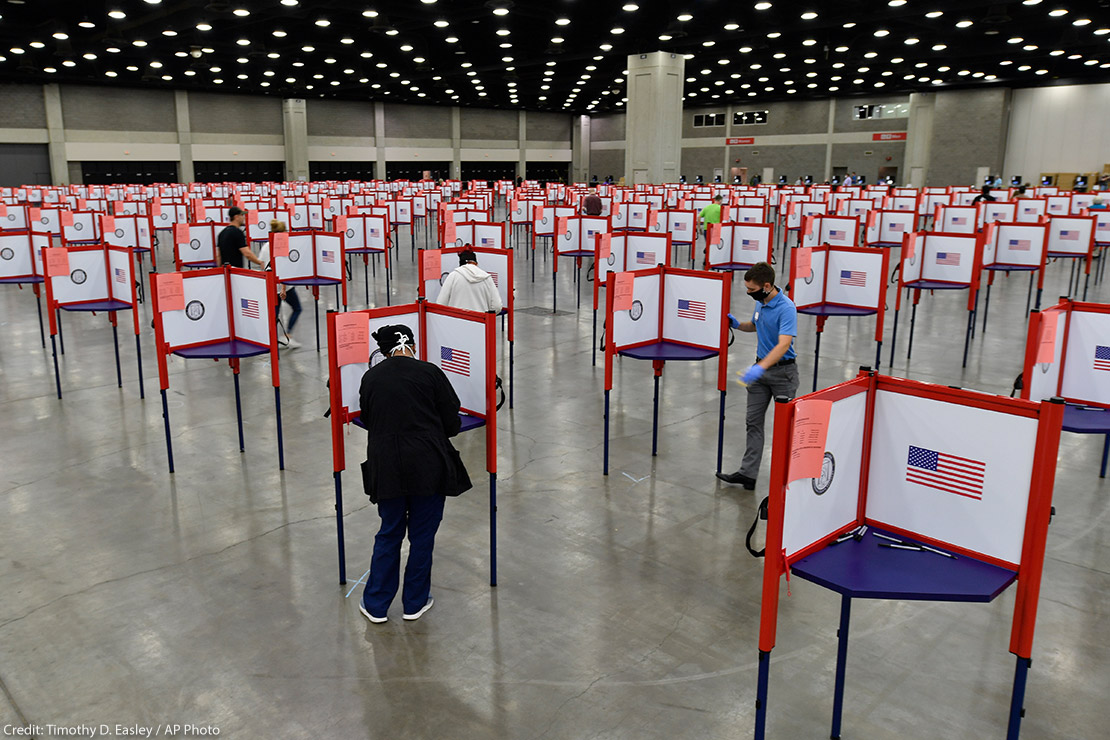

Now although the contribution may seem like a donation to you it is important to know that political donations are not tax deductible. As of 2020 four states have provisions for dealing with political contributions. Americans are encouraged to donate to political campaigns political parties and other groups that influence the political landscape.

The most you can claim in an income year is. A contribution donation or payment made as a contribution to contribution donations or payments for any of these that amount cant be deducted from your taxes. Are Political Donations Tax Deductible.

Political contributions are not tax deductible though. The IRS guidelines also go beyond just direct political contributions.

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Taxact Blog

Inside The Political Donation History Of Wealthy Sports Owners Fivethirtyeight

How The Aclu Is Flexing Its Political Muscle In The 2020 Elections News Commentary American Civil Liberties Union

The Truth About Political Donations There Is So Much We Don T Know

The Complete Political Fundraising 2022 Guide Numero Blog

Are Political Donations Tax Deductible Credit Karma Tax

Inside The Political Donation History Of Wealthy Sports Owners Fivethirtyeight

The Dodo On Twitter Watch This Plain Little Caterpillar Transform Caterpillar Macro Photos Luna Moth

A Field Guide To Green The Outside Groups That Will Be Spending Tens Of Millions In Minnesota This Election Season Minnpost

Inside The Political Donation History Of Wealthy Sports Owners Fivethirtyeight

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Tax Bill Could Create Deduction For Dark Money Political Donations The Hill

What The Hell Is Actblue And Why Is It Showing Up On So Many Democratic Candidates Campaign Finance Reports Minnpost

Michigan Redistricting Group Brings In Whopping 13 9 Million Bridge Michigan

Don T Let Congress Convert Charities Including Churches Into Dark Money Political Organizations Nonprofit Law Blog

Are Political Contributions Tax Deductible Personal Capital

1 Billion In Gifts Attracts New Attention To The Rules On Charities And Political Giving